Trump and SoftBank’s $100 Billion Gamble on AI and U.S. Economic Revival

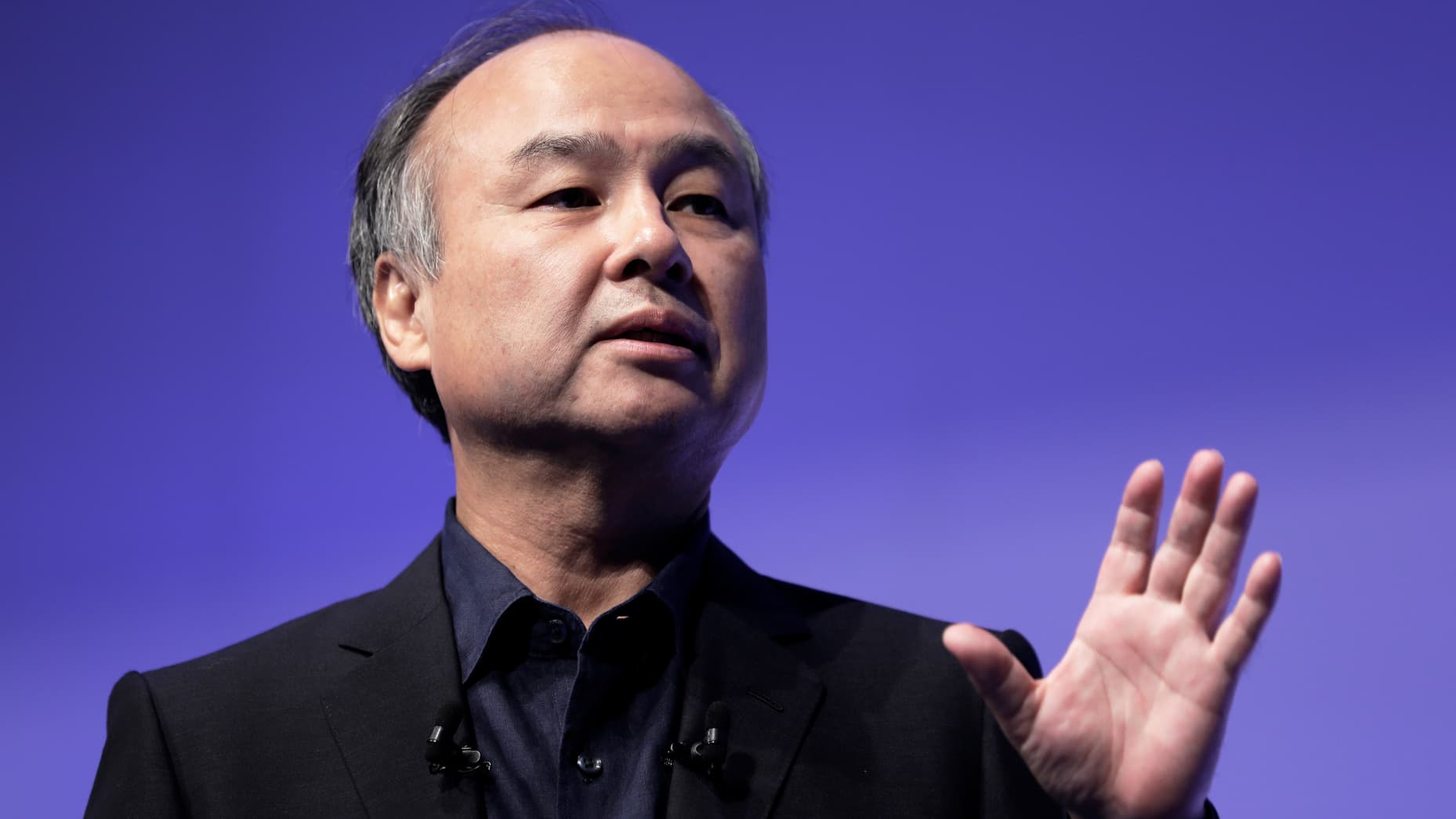

PALM BEACH, Florida, Dec 16 (Reuters) – In a high-profile announcement at Mar-a-Lago, President-elect Donald Trump and SoftBank Group CEO Masayoshi Son unveiled a $100 billion investment plan aimed at supercharging the U.S. economy. The pledge, set to unfold over the next four years, is projected to create 100,000 jobs in cutting-edge fields like artificial intelligence and infrastructure, providing a major boost to the nation’s economic landscape.

Trump, with Son at his side, described the investment as a testament to “monumental confidence in America’s future” and playfully urged Son to double the commitment to $200 billion. Son, with a chuckle, promised to “try.” The announcement mirrors a similar event in December 2016 when Son, alongside then-President-elect Trump, pledged $50 billion and 50,000 jobs—though it remains unclear if those targets were fully realized.

The $100 billion commitment aligns with Trump’s broader efforts to revitalize the U.S. economy and curb inflation as he prepares for his second term, beginning January 20. However, questions remain about how SoftBank will finance the ambitious plan. As of September 30, SoftBank had $27 billion in cash and $3 billion remaining in its Vision Fund 2. Sources suggest additional capital could come from chipmaker Arm Holdings or other ventures.

SoftBank, recovering from setbacks such as the high-profile failure of WeWork and declining valuations in its Vision Fund portfolio, has recently focused on rebuilding its financial strength. Despite past challenges, SoftBank shares surged over 3% in Tokyo following the announcement, reflecting investor optimism.

Masayoshi Son, a vocal advocate of AI’s transformative potential, has been bolstering SoftBank’s exposure to the sector. Recent moves include taking a stake in OpenAI and acquiring chip startup Graphcore. Son has consistently emphasized his belief in the emergence of artificial super-intelligence, which he says will require hundreds of billions of dollars in investment. In October, he hinted at preparing for a “next big move” without revealing specifics.

Skeptics, however, question the feasibility of such plans. “What are they going to buy? The low-hanging fruit in AI has already been picked,” noted Amir Anvarzadeh, Japan equity strategist at Asymmetric Advisors. Similarly, Astris Advisory analyst Kirk Boodry observed that the pledge appears to rely heavily on pre-existing commitments, suggesting little change in SoftBank’s investment trajectory.

Trump, known for grandiose announcements of job creation, has faced scrutiny over the actual outcomes of such promises. Early in his first term, a $10 billion Foxconn investment in Wisconsin touted as a major job creator largely fizzled out. Despite this, Trump last week pledged to fast-track permitting for companies investing over $1 billion in the U.S., underscoring his commitment to fostering economic growth.

As details of the $100 billion investment unfold, the initiative remains a bold gamble on America’s AI-driven future and a defining moment in Trump’s economic agenda.