Phillips 66 vs. Elliott Management: A Modern Corporate Showdown Over the Value of Conglomerates

In the high-stakes world of corporate finance, a familiar question has returned to the spotlight: Are the pieces of a big company more valuable together—or apart?

At the center of this debate is Phillips 66, a sprawling oil refiner and energy logistics giant, and Elliott Investment Management, one of Wall Street’s most aggressive activist investors. What’s unfolding is a classic conglomerate quandary, with modern implications for shareholders, energy markets, and the future of diversified corporations.

Let’s dive deep into why this battle matters—and what it reveals about the evolving corporate landscape.

The Company: Phillips 66’s Broad Empire

Phillips 66 is far from a one-dimensional energy company. With operations in refining, midstream logistics, chemicals, and marketing, it’s a textbook example of a conglomerate built on vertical integration and industry breadth.

This model worked well for decades. The company could weather oil price volatility by leveraging its downstream businesses and extract synergies across its units. It provided stability, optionality, and operational control—everything Wall Street traditionally loved.

But that love is fading.

The Challenger: Elliott’s Push for Separation

Enter Elliott Management, a firm known for its strategic shakeups and value-unlocking campaigns at companies like AT&T, Twitter, and Hess.

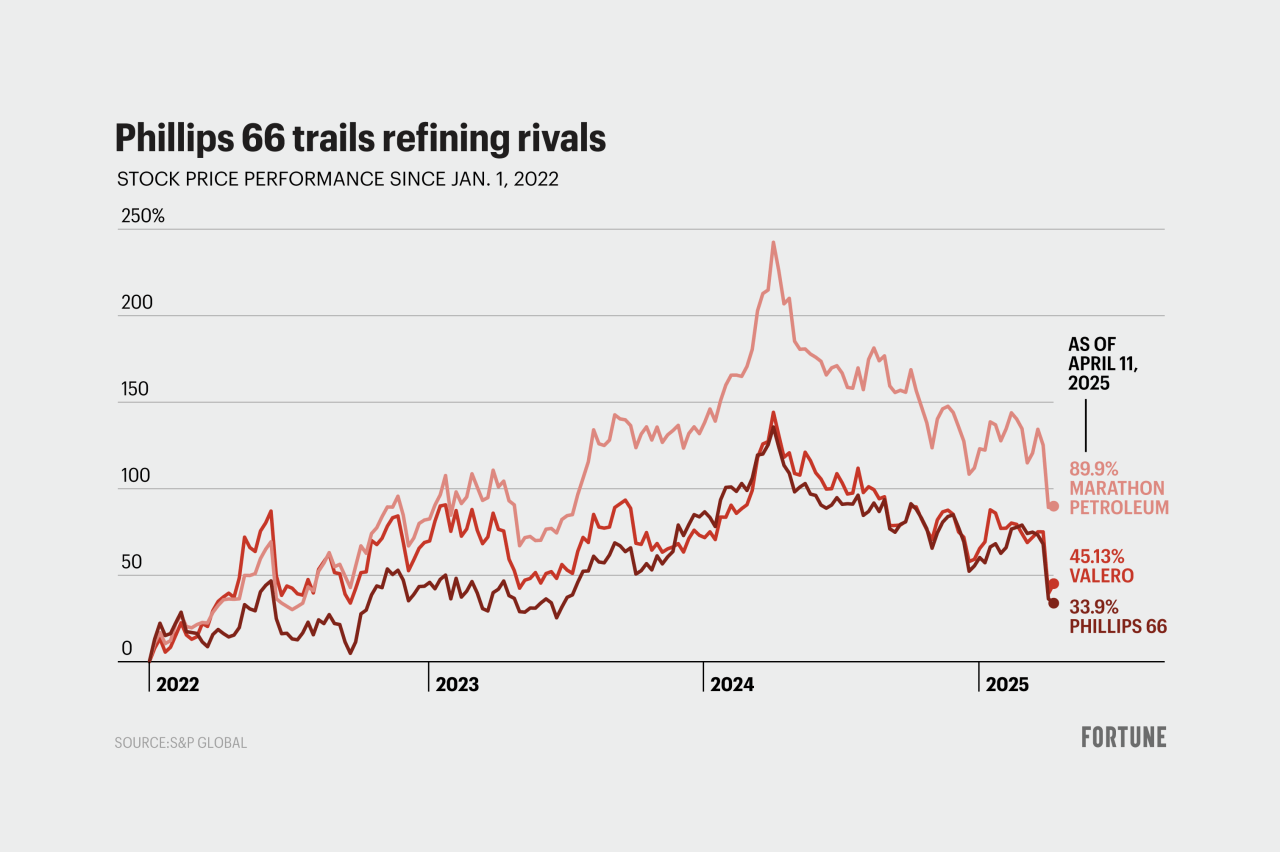

Elliott’s core argument? Phillips 66 is underperforming, and its diverse operations are holding back its true potential. According to the activist investor, the company’s various segments—especially its high-margin midstream and chemicals units—are being undervalued due to their bundling with lower-margin refining operations.

Elliott contends that breaking up the company or spinning off certain assets could unlock billions in shareholder value, allowing each business to be valued based on its own fundamentals and market dynamics.

They’ve taken a significant stake in Phillips 66 and are now publicly pressuring the board for changes.

The Core Debate: Synergy vs. Simplicity

This standoff reignites a long-running Wall Street debate.

- Conglomerate defenders, like Phillips 66’s leadership, argue that keeping various segments under one umbrella creates resilience and strategic advantage. When one part of the business suffers, another might thrive, ensuring stability. Integration can also reduce costs and provide flexibility.

- Critics, like Elliott, believe these benefits are outdated or overstated. In today’s fast-moving, investor-focused landscape, clarity and specialization often command higher valuations. Investors want to bet on pure plays, not manage risk across business lines they may not understand.

Elliott’s Playbook: Proven, but Controversial

Elliott isn’t just waving theory. Their track record of successful breakups and restructuring speaks for itself.

- At Marathon Petroleum, Elliott pushed for the separation of its pipeline and fuel retail arms, leading to a surge in market value.

- At Hess, Elliott advocated for management and capital allocation changes that significantly improved returns.

Their approach is bold and sometimes bruising, but it often forces companies to reassess their strategy—and unlock shareholder value in the process.

Phillips 66’s Response: Stay the Course?

So far, Phillips 66 has resisted a dramatic breakup, signaling confidence in its integrated model. It argues that its multi-business structure gives it the long-term capacity to navigate energy transition risks and capitalize on growth across the entire energy value chain.

Still, it has acknowledged the need to streamline operations and boost returns, which could open the door to some compromises—or preemptive restructuring to appease investors before things escalate.

Why This Fight Matters

Beyond Phillips 66 and Elliott, this clash reflects a broader shift in corporate America:

- Conglomerates are under pressure. From GE to Johnson & Johnson, major firms have recently announced breakups, spinoffs, or major overhauls to simplify operations and boost valuations.

- Activist investors have more influence than ever. They are no longer fringe players but mainstream power brokers, reshaping boardrooms and strategy at some of the world’s largest firms.

- Shareholders are prioritizing value clarity. Especially in volatile sectors like energy, investors increasingly want specialized plays over diversified bets.

The Road Ahead

Whether Phillips 66 bends to Elliott’s demands remains to be seen. It could lead to a full or partial breakup, an internal restructuring, or simply a more aggressive shareholder-return strategy.

But one thing is clear: this battle will shape not just the future of one company—but the fate of the conglomerate model itself in the modern era.

For investors, business strategists, and corporate leaders alike, the Phillips 66 vs. Elliott saga is more than a boardroom spat—it’s a case study in how the rules of value creation are being rewritten in real time.