Quantum Computing Stocks Tumble After Nvidia CEO’s Cautious Forecast

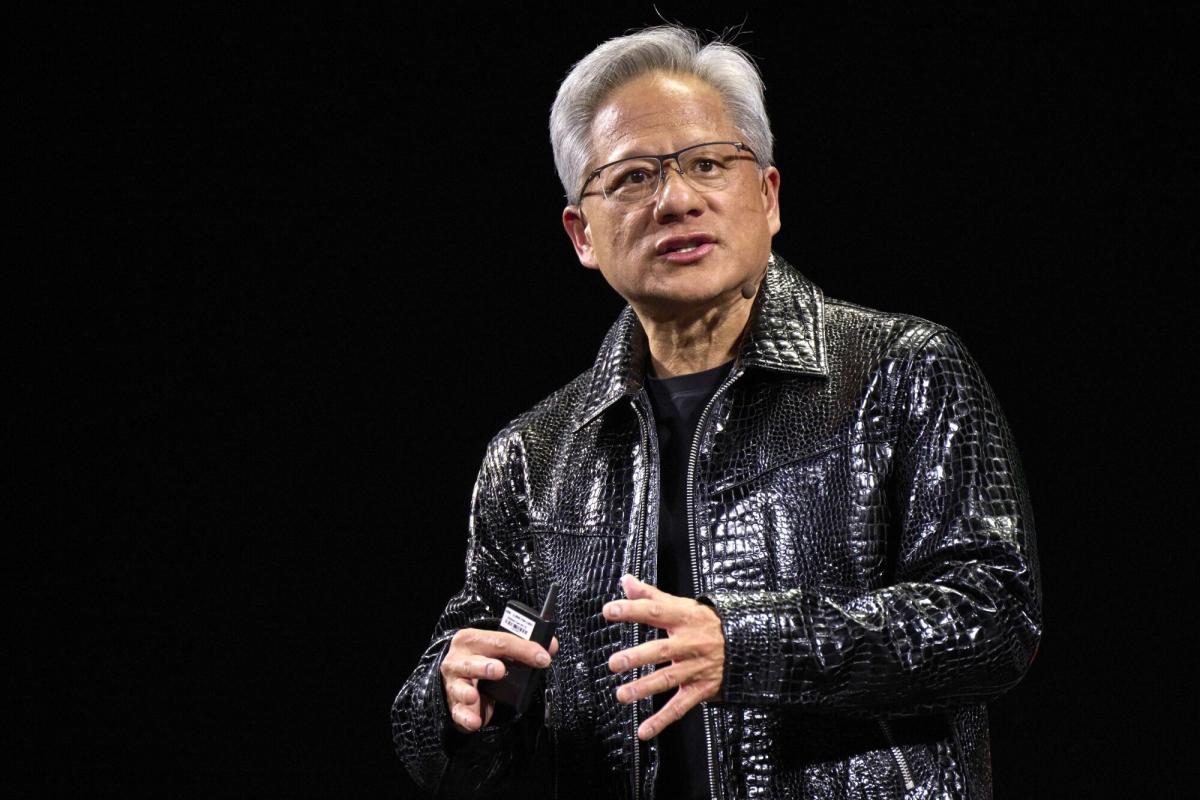

Quantum computing stocks plunged on Wednesday after Nvidia CEO Jensen Huang suggested that the industry is still decades away from delivering practical quantum computers. Speaking during Nvidia’s analyst day, Huang stated, “If you said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30, it’s probably on the late side. But if you picked 20, I think a whole bunch of us would believe it.”

Huang’s comments sparked a sharp sell-off in the quantum computing sector. Rigetti Computing’s shares plummeted 25%, IonQ fell over 13%, and D-Wave Quantum dropped more than 19%. Quantum Computing Inc., which recently announced a $100 million stock offering, sank 21%, and the broader Defiance Quantum & AI ETF declined 3%.

The remarks follow a period of heightened enthusiasm in the quantum space, driven by Google’s advancements in reducing quantum computing errors with its Willow chip. The announcement had fueled dramatic rallies, with Rigetti and D-Wave surging 1,449% and 854%, respectively, by the end of 2024. However, Huang’s tempered outlook has cast a shadow over the sector’s near-term prospects.

Despite the cautionary tone, Huang expressed confidence in Nvidia’s role in advancing quantum computing, stating the company will play a “very significant part” in helping the industry reach its goals as quickly as possible. While the technology holds immense potential for applications like drug discovery and cryptography, the journey toward commercialization remains complex and uncertain.

Investors and industry leaders alike continue to grapple with the challenges of turning quantum computing’s promise into reality. For now, the sector’s long-term potential remains intact, but patience will be key as the field matures.