Super Micro Stock Plunges After Surprise Customer Delays Cost Up to $1.4 Billion in Sales

Super Micro Computer Inc. (NASDAQ: SMCI), a leading server and computing solutions provider, saw its stock price plummet after announcing an unexpected delay in customer orders—costing the company between $1 billion and $1.4 billion in lost sales. The tech firm, which had been riding high on the AI infrastructure boom, shocked investors with the update, triggering a double-digit stock drop and sparking concerns about its revenue trajectory in the near term.

What Happened? Surprise Delay From Key Customer

On April 29, 2025, Super Micro disclosed during its earnings report that several large customer shipments had been delayed unexpectedly, pushing significant revenue into the following quarter. The company, known for its high-performance computing (HPC) servers used in AI, cloud, and enterprise data centers, stated that the delays were logistical rather than demand-related.

However, the timing and magnitude of the delays—estimated at up to $1.4 billion—caught analysts off guard. For a company with quarterly revenue expectations in the $3-4 billion range, the hit was substantial.

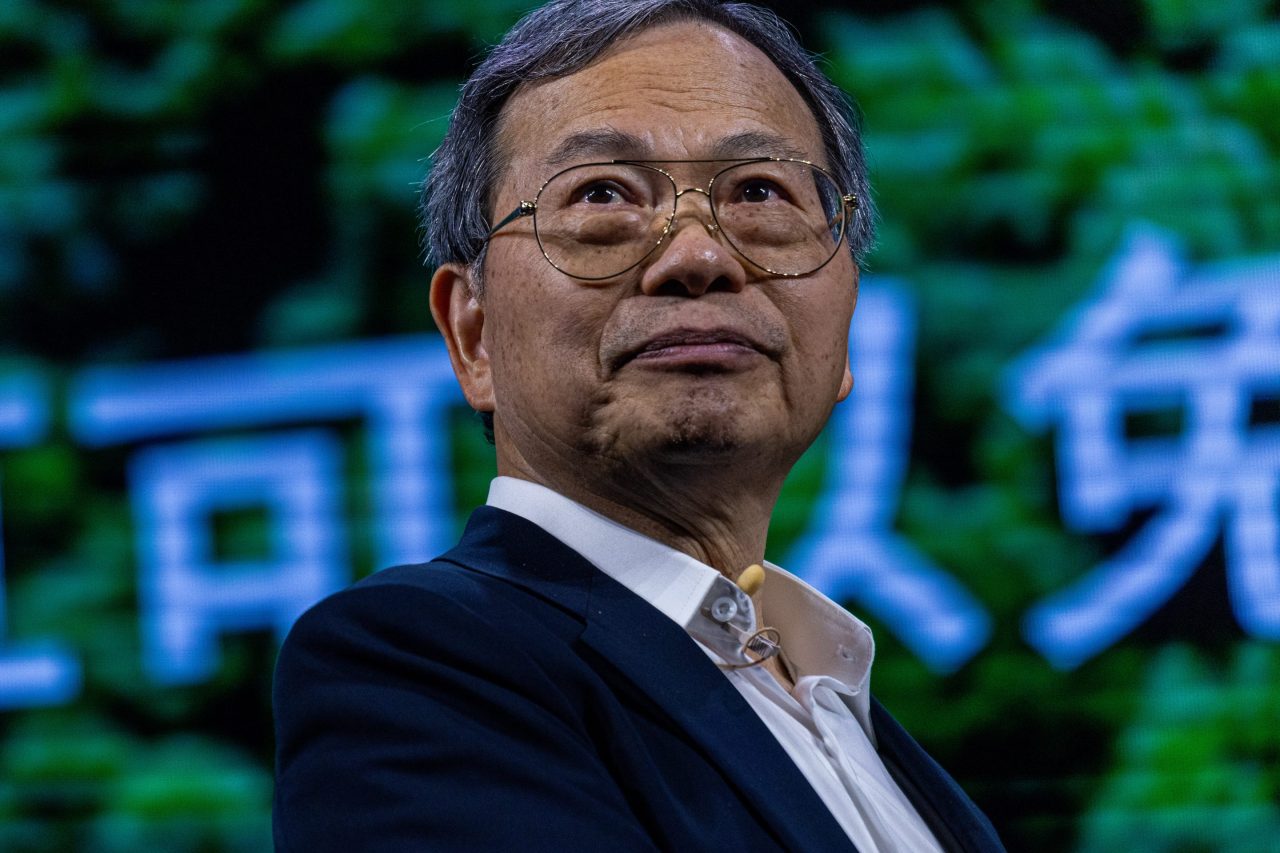

CEO Reassurance Not Enough to Calm Markets

CEO Charles Liang attempted to reassure investors during the earnings call, emphasizing that the orders were not canceled but merely delayed. “We remain confident in our long-term growth story,” Liang said. “These systems will ship. It’s just a matter of timing.”

Still, investors were rattled. The stock tumbled more than 16% in after-hours trading, erasing a large portion of the year-to-date gains Super Micro had enjoyed thanks to strong demand for AI-focused server infrastructure.

A Painful Blow Amid AI Boom

Super Micro has been one of the biggest beneficiaries of the AI infrastructure boom, with partnerships involving NVIDIA, Intel, and AMD, and has delivered custom high-density servers for large language models, cloud workloads, and hyperscalers. The company’s ability to rapidly scale and customize solutions helped it ride the AI wave faster than traditional players.

Its meteoric rise—over 800% in 2023 alone—had placed it in the spotlight as one of the top AI-related stocks on Wall Street.

That’s why this earnings miss felt particularly dramatic: Wall Street had priced in near-flawless execution. The reality proved more complicated.

Analyst Reactions: “Execution Risk Now Front and Center”

Following the announcement, analysts from JPMorgan, Morgan Stanley, and BofA quickly issued revised guidance and warnings about execution risk.

“This quarter revealed the fragility of expectations when demand visibility is murky,” said a Morgan Stanley analyst. “Investors must now price in potential volatility.”

Some firms still maintain a bullish long-term outlook but have lowered near-term price targets, with a consensus that execution and logistics will be closely scrutinized over the next few quarters.

What This Means for Investors

The stock drop has created short-term volatility, but several analysts believe it may present a buy-the-dip opportunity for long-term investors—assuming the customer delays are resolved as promised.

Key Risks to Watch:

- Further customer deferrals or cancellations

- Slower-than-expected AI infrastructure adoption

- Supply chain bottlenecks

- Margin compression due to rush shipments or custom configurations

Potential Upside:

- Catch-up revenue in the next quarter

- Continued AI and data center growth

- Competitive edge in customization and rapid deployment

Revenue Guidance Adjusted, But Growth Story Remains

Despite the quarterly revenue hit, Super Micro raised its fiscal year 2025 guidance slightly, projecting strong backlog growth and robust demand for next-gen GPU and AI server systems. This suggests that long-term demand remains intact, though the timing of revenue recognition has shifted.

Final Thoughts: Bump in the Road or Warning Sign?

The sharp drop in Super Micro’s stock after the customer delay news highlights the fragility of high-growth tech valuations in today’s market. While the company remains a key player in the AI and data center boom, the episode has introduced new doubts about timing, execution, and scalability.

Investors and analysts will be watching the next quarter closely to see if delayed shipments convert into real sales—or if this marks the beginning of a more turbulent growth phase.